Our business partners

We work together with the following partners to find and to bring you a wide range of solutions.

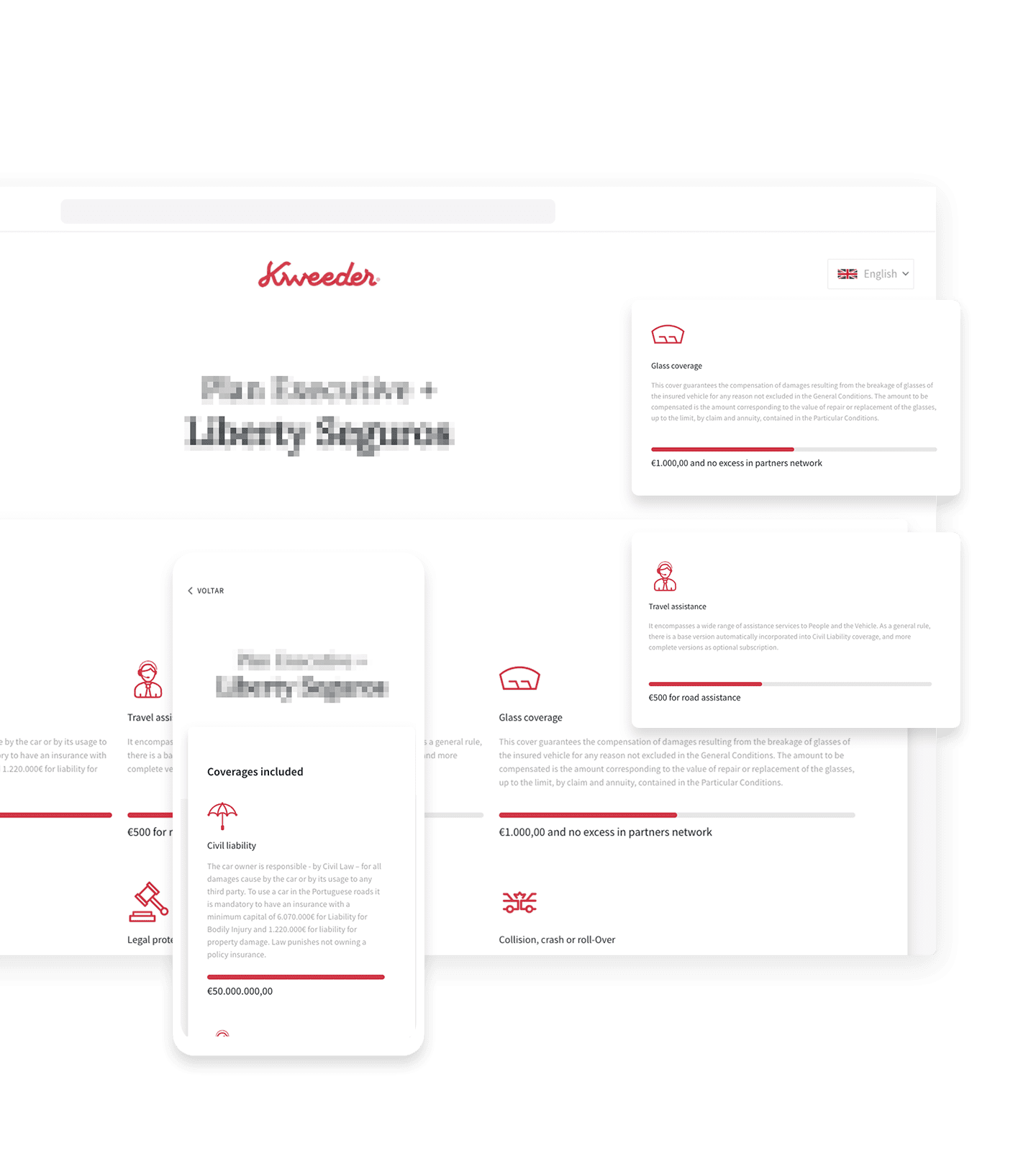

A dedicated team to help you to find the best insurance policy.

Team of professionals willing to help you to find the best insurance solution for you. Buy your insurance through Kweeder and have direct access to your account manager to support you on a day to day of your insurance policy.

Why is Home Insurance Important?

Home insurance is crucial for various reasons, providing financial protection and peace of mind for homeowners.

Here are some key reasons why having home insurance is important:

- Property Protection

- Home insurance safeguards your home from risks like fire, lightning, windstorms, hail, explosions, vandalism, and other covered perils. In case of damage, the policy helps cover repair costs or even a full replacement for total loss.

- Personal Belongings Coverage

- Home insurance typically covers personal belongings within your home, including furniture, electronics, clothing, and more, against covered perils. This is crucial in events like theft, fire, or other disasters.

- Liability Coverage

- Home insurance includes liability coverage, protecting you if someone is injured on your property or if you accidentally damage someone else's property. It can assist with legal expenses, medical bills, and other costs related to a liability claim.

- Additional Living Expenses

- This optional cover provides assistance if your home becomes uninhabitable due to a covered peril. Home insurance can cover additional living expenses, including temporary housing, meals, and other necessary costs during home repairs or rebuilding.

- Mortgage Requirements

- If you have a mortgage, your lender may require home insurance to protect their investment. Insurance ensures that the property can be repaired or rebuilt in case of damage, meeting mortgage requirements.

- Financial Security

- Home insurance offers financial security by helping you recover from unexpected and significant financial losses. Without insurance, you might bear the entire burden of rebuilding, repairing your home, and replacing personal belongings.

- Natural Disasters

- Home insurance often covers damage caused by natural disasters such as earthquakes, floods, and hurricanes. Given the unpredictable nature of these events, having insurance is crucial to mitigate the financial impact.

It's important to thoroughly read and understand the terms and conditions of your home insurance policy, as coverage may vary between policies and providers. Factors like your location, home features, and personal considerations can influence the type of home insurance that suits you best.

Buy home insurance that suits your needs

Building Insurance

This insurance could cover the cost of repairing damage or rebuild the structure of the house, including the roof and walls. It can also cover any permanent fixtures and fittings, such gardens, swimming pools as well as windows or kitchen units. This insurance is required for homeowners and landlords.

Contents Insurance

This insurance could cover the contents inside your home against damage or theft. Contents are all the items that you can carry with you and normally include furniture, home appliances, clothes, and carpets. It can also cover high-value items in your home, such as jewellery and bicycles.

Combined Home Insurance

Combining buildings and contents insurance under one policy from the same provider can make it more convenient if you need to make a claim. Combined insurance can often work out cheaper than taking out separate policies. But you should always compare house insurance quotes to make sure it is the right option for you.

What Factors Influence Home Insurance Costs?

The cost of home insurance is influenced by various factors, reflecting the risk of damage or loss associated with your home. Understanding these factors is crucial in determining your premiums.

Here are key factors that can influence the cost of your home insurance:

- Property Size

- The size of your property impacts rebuild costs. Larger properties generally incur higher costs for rebuilding compared to smaller homes.

- Property Location

- Crime rates, area affluence, and flood risk in your location can affect insurance costs. Different locations have varying rebuilding costs and associated risks.

- Construction Year

- The construction year of your home matters. Older homes may have features or materials that are expensive to replace, along with outdated plumbing and electrical systems that increase the risk of damage.

- Home Security

- Investing in home security measures, such as alarms, security entrance doors, window locks, and smoke detectors, can reduce your risk in the eyes of insurance providers.

- Building Materials

- Properties made from non-typical materials or listed buildings can be more expensive to insure due to unique construction characteristics.

- Value of Possessions

- The value of your possessions affects insurance costs. Discriminate highly valuable items for coverage, while common contents may not need specific discrimination.

- Optional Coverages

- Additional coverages like accidental damage and home emergency cover may not be included as standard. You might need to pay extra to add these covers to your policy.

It's essential to recognize that these factors play a significant role in determining your home insurance costs. Evaluate these considerations to make informed decisions about your coverage and premiums.

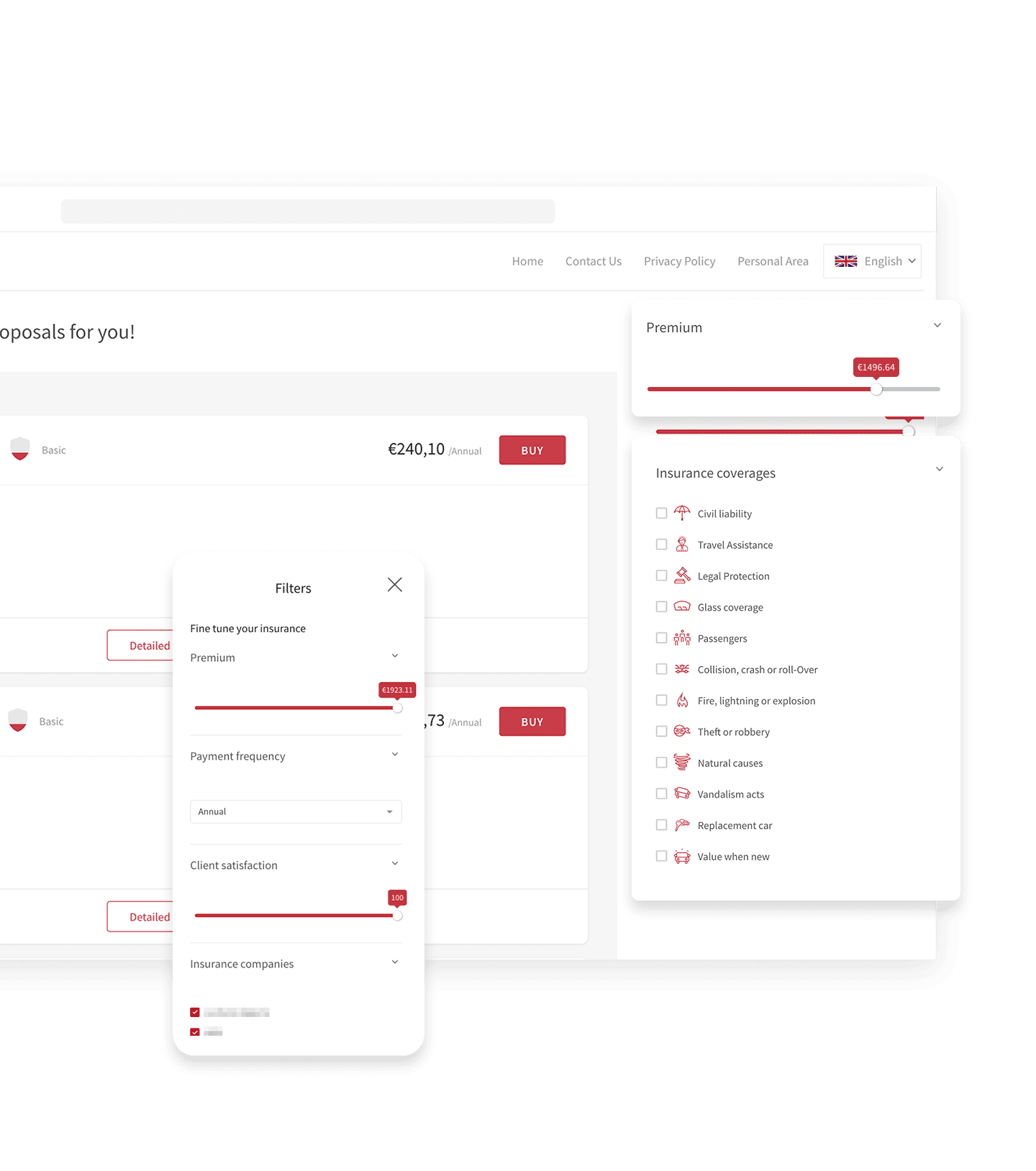

What Information Do I Need for a Home Insurance Quote?

To start a home insurance simulation with Kweeder, you should gather some basic information about your property. This includes:

- Details about your property

- Post Code, Construction Year, Typology, Property Type, and usage.

- The level of coverage you need

- Building, Content, Building + Content.

- The rebuild value of your home

During the simulation process, we will ask you additional questions to ensure we have all the necessary information, including your personal details, to provide you with various quotes from insurance companies.

Frequently asked questions

What is a home insurance?

The mortgage life insurance is a contract whereby the insurer undertakes to pay the agreed capital upon the insured's death (death insurance) or survival (life insurance). Mortgage life insurance may also includes supplementary coverages that provide financial support in case of disability from the insured person. By contracting a mortgage life insurance, the insured can also benefit from daily financial support while hospitalized.