Car Insurance

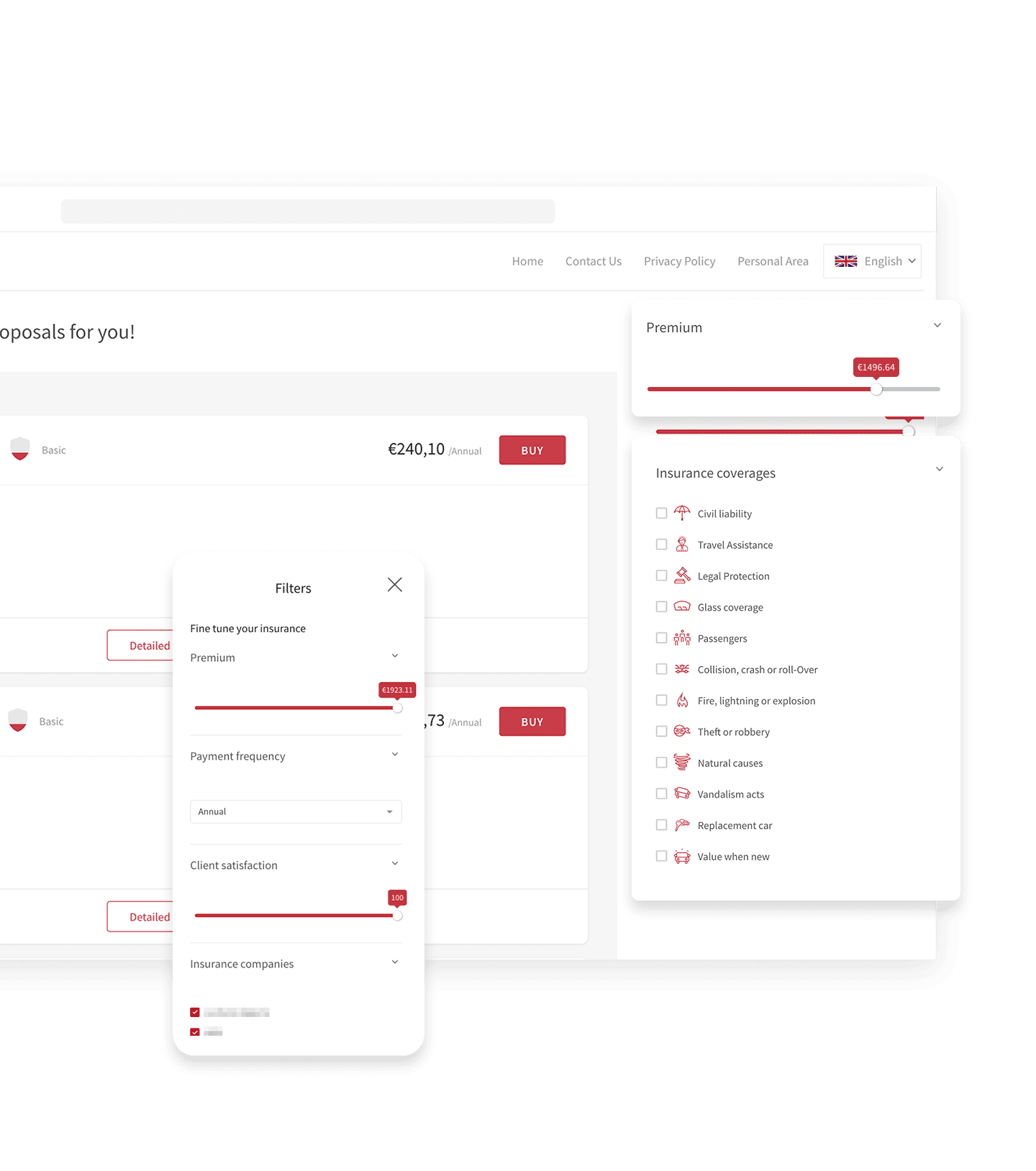

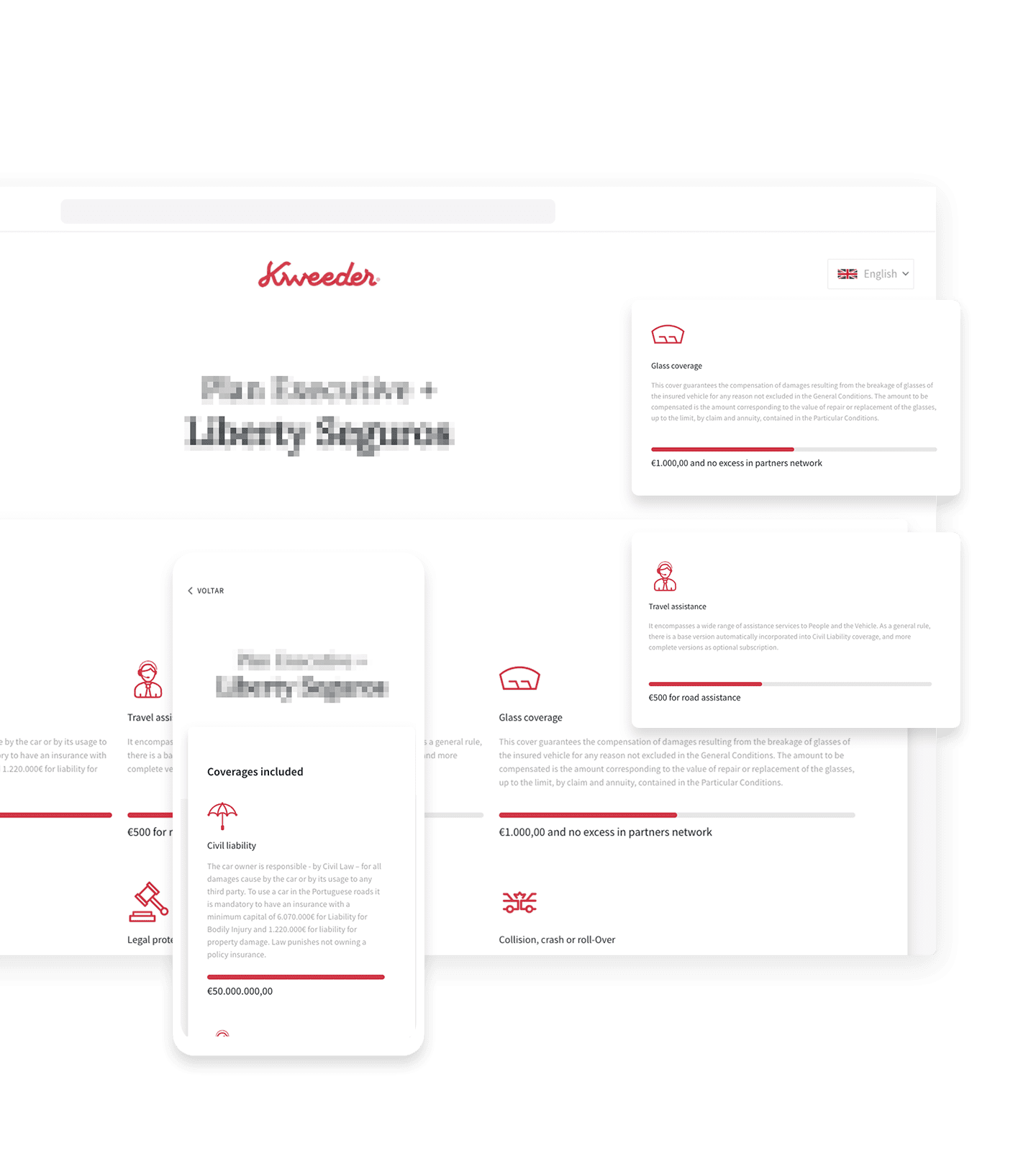

Car Insurance Aggregator. Compare, Buy and Manage Your Insurance Policies and Receipts.

Kweeder compares the best car insurance offers in the markets and provides you professional advice when is time to buy. Buy your car insurance with Kweeder and manage all your policies and receipts in one single place directly from your home.

Our business partners

We work together with the following partners to find and to bring you a wide range of solutions.

1 / 4

Maria

Magda

Filipa

Sandra

A dedicated team to help you to find the best insurance policy.

Team of professionals willing to help you to find the best insurance solution for you. Buy your insurance through Kweeder and have direct access to your account manager to support you on a day to day of your insurance policy.

Frequently asked questions

Is it possible to obtain an insurance contract online?

Yes, it is possible to make a valid insurance contract online and/or by phone. In the same way as an in-person contract, the conclusion of a contract online or by phone, requires your terms and condition acceptance as well the confirmation from the insurance company.